In the fast-paced world of Forex trading, efficiency is key. Discover how post-trade automation and capture technologies are revolutionizing operations, streamlining processes, and enhancing customer satisfaction.

Streamlining Forex Operations with Post Trade Automation and Capture

In the dynamic realm of Forex trading, efficiency is paramount. From trade execution to post-trade operations, every aspect demands precision and speed. However, the traditional manual methods often lead to delays, errors, and inefficiencies. This is where post-trade automation and capture come into play, revolutionizing the way Forex businesses operate.

Post Trade Automation: Enhancing Efficiency

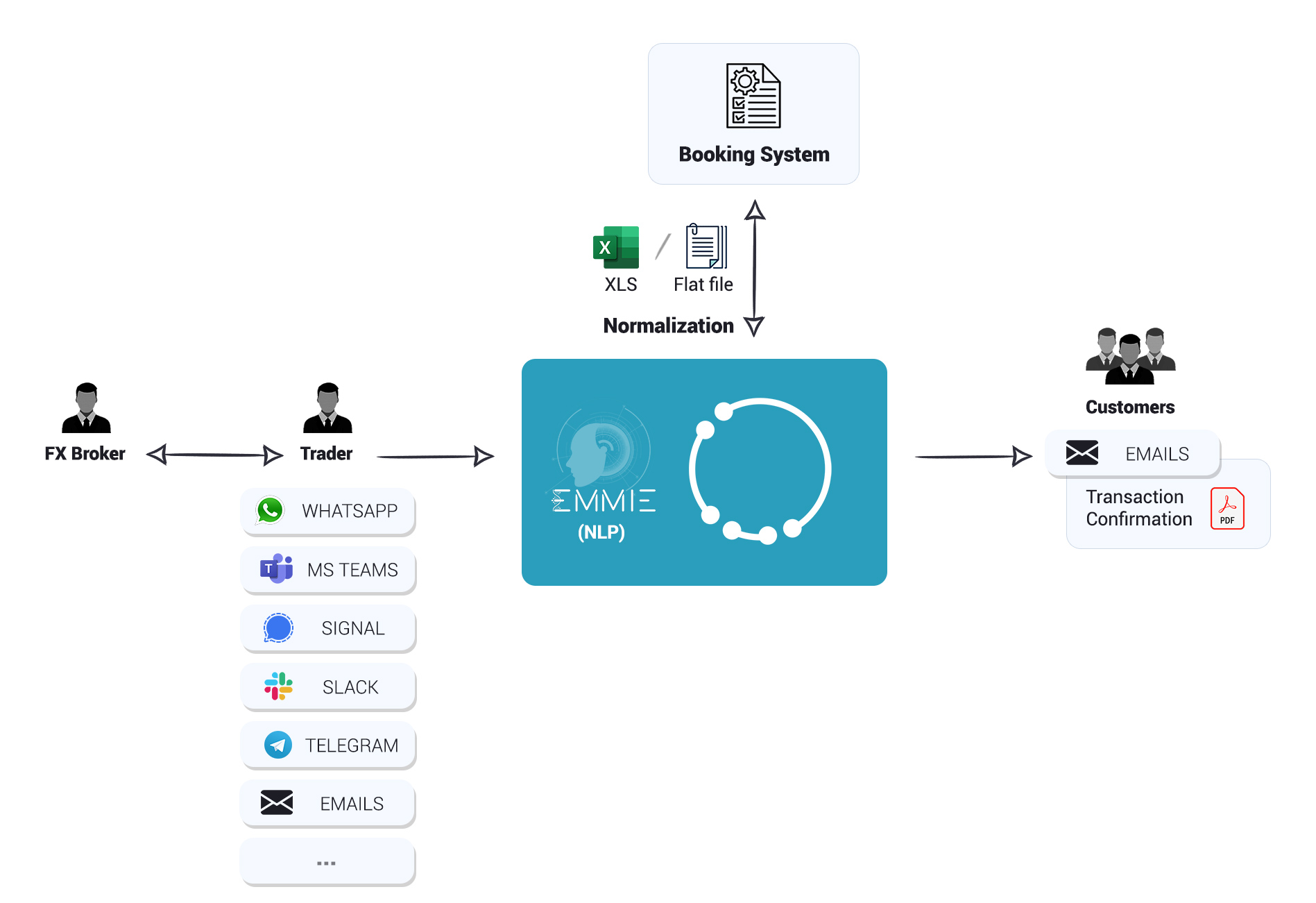

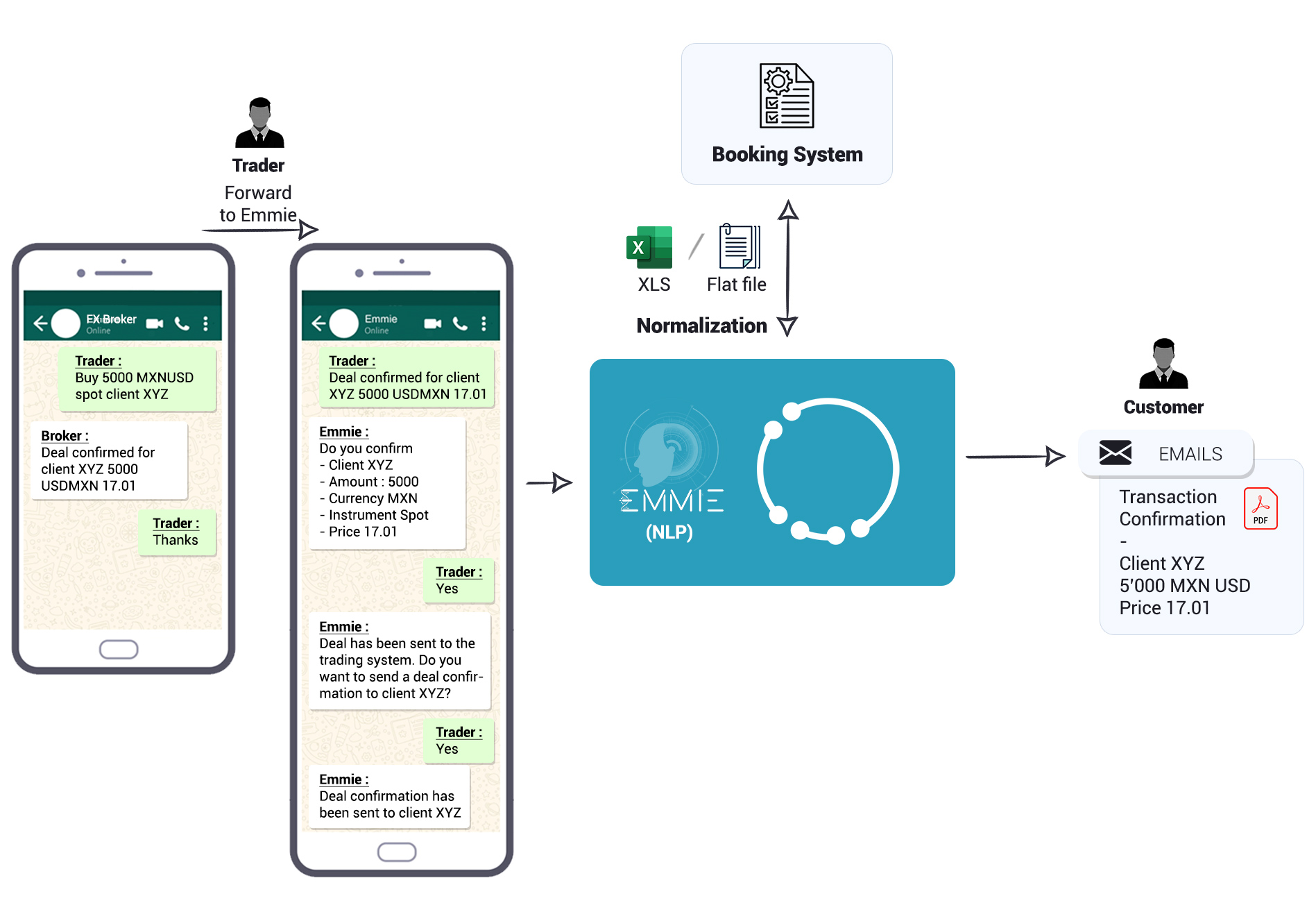

Post-trade automation involves the use of technology to streamline and automate processes that occur after a trade is executed. It aims to eliminate manual intervention, reduce processing time, minimize errors, and enhance overall operational efficiency.

At Terranoha, we understand the challenges faced by Forex industry players in handling post-trade activities. Whether it’s processing trade requests, reconciling data, or managing risk, our post-trade automation solutions are designed to address these pain points effectively.

Benefits of Post Trade Automation:

- Error Reduction: By automating repetitive tasks, the risk of human errors is significantly reduced, ensuring accuracy in post-trade processes.

- Time Efficiency: Manual processing of trade requests and data reconciliation can be time-consuming. Automation accelerates these processes, enabling quicker trade settlements and improved customer service.

- Risk Management: With automated risk monitoring and management systems in place, Forex businesses can mitigate operational and financial risks effectively.

- Enhanced Customer Experience: Timely execution and accurate processing of trade requests lead to higher customer satisfaction and retention.

Post Trade Capture: Capturing Trade Data for Analysis

Post-trade capture involves the collection and recording of trade data for analysis, reporting, and compliance purposes. It encompasses gathering trade details such as trade date, price, volume, and counterparty information.

Terranoha’s post-trade capture solutions ensure seamless data capture and integration with your existing systems. Whether it’s capturing trade data from client interactions or integrating with third-party platforms, our technology simplifies the process, allowing you to focus on strategic decision-making.

Benefits of Post Trade Capture:

- Data Integrity: Accurate capture and storage of trade data ensure data integrity and compliance with regulatory requirements.

- Real-time Reporting: By capturing trade data in real-time, Forex businesses gain access to timely insights for performance analysis and decision-making.

- Compliance: Automated capture of trade data facilitates regulatory compliance, reducing the risk of penalties and legal issues.

- Audit Trail: Comprehensive trade data capture creates a transparent audit trail, enabling traceability and accountability.