Robotic Process Automation (RPA) is quickly becoming a popular technology for streamlining operations in the financial sector. RPA is a form of automation technology that uses software bots to automate mundane and repetitive tasks. By automating these tasks, organizations can save time and money, improve customer experience, and increase the accuracy of their operations.

Unlocking New Levels of Efficiency

Robotic Process Automation can be used in a variety of processes, from customer onboarding to data entry to payments processing. It can also be used to analyze complex data and generate insights. For example, RPA technology can be used to analyze customer data and identify trends in customer behavior, or to identify risk areas in the financial landscape.

RPA is also a cost-effective solution for financial institutions. By automating mundane tasks, organizations can free up resources to focus on more complex tasks and customer service. Furthermore, RPA technology can reduce errors and increase accuracy, resulting in fewer costly mistakes and improved customer satisfaction.

Harness the Power of Robotic Process Automation with Terranoha

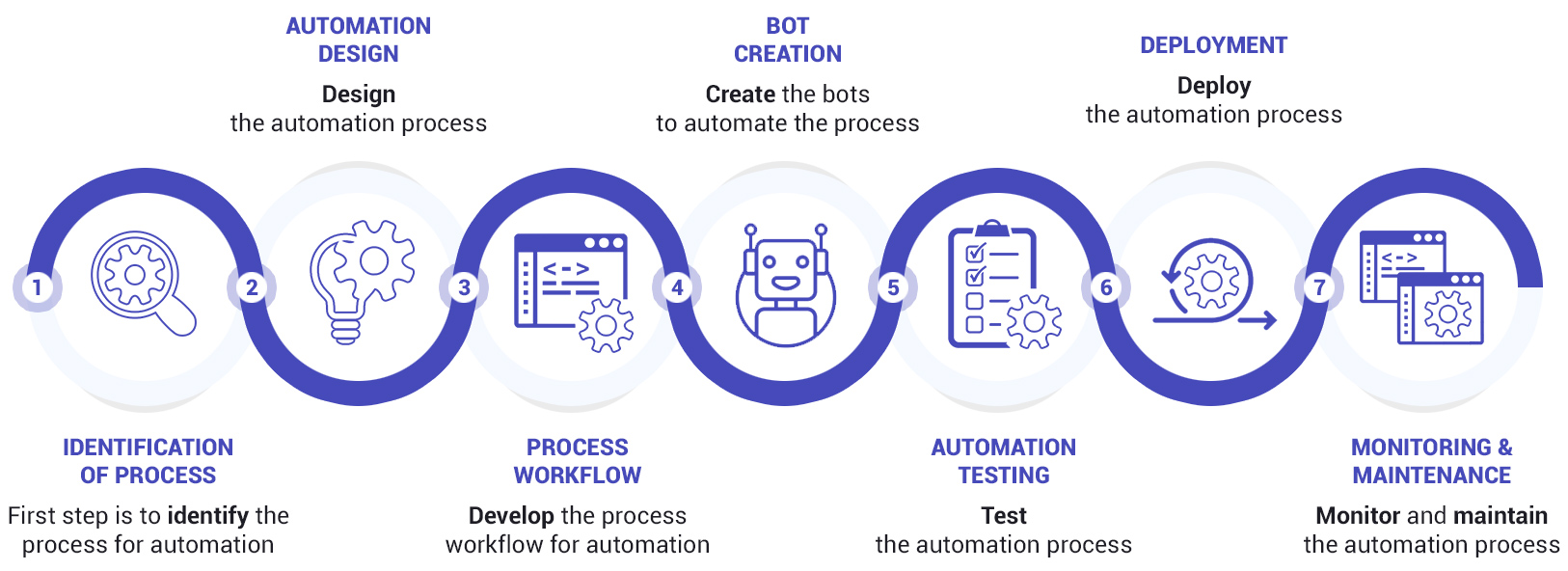

Terranoha is one of the leading providers of robotic process automation technology. We offer a comprehensive platform for RPA that includes a range of tools and services. These include tools for automation design and development, workflow automation, and analytics. Our platform also allows users to connect their existing systems to the RPA platform, allowing for seamless integration with existing processes.

Related Article

Discover the Benefits of RPA with Terranoha‘s Platform

By using robotic process automation, financial institutions can increase efficiency, reduce costs, and improve customer service. Terranoha’s platform is designed to make it easy for organizations to get started with RPA and to quickly and easily integrate it into existing processes.