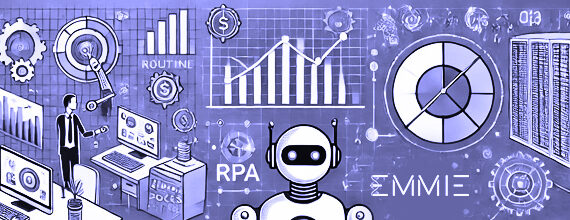

Robotic Process Automation (RPA) is a game-changing technology that is revolutionizing the finance industry. RPA is driving automation in the finance sector by automating manual tasks, streamlining processes, and improving productivity and accuracy.

In the world of financial technology (fintech), robotic process automation (RPA) is revolutionizing the way companies conduct business. RPA is a form of artificial intelligence (AI) that automates repetitive, mundane tasks that are traditionally performed by humans. By eliminating manual tasks, companies are able to reduce costs, improve efficiency, and improve customer service.

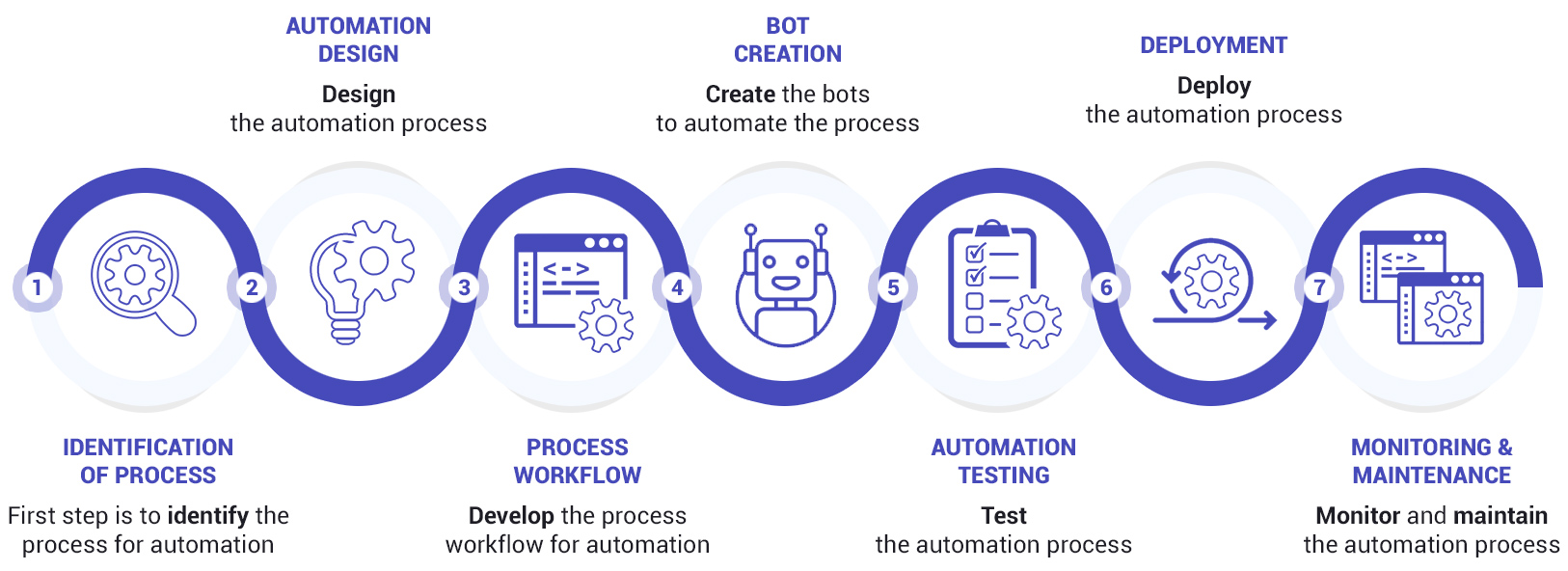

Many financial companies are leveraging the power of RPA to streamline their operations and maximize their profits. By automating routine tasks such as data entry, transaction processing, and other back-office activities, companies can reduce their labor costs while increasing their productivity. Additionally, RPA allows companies to reduce their manual errors and improve accuracy.

Terranoha is utilizing RPA to its fullest potential

Terranoha is a cloud-based financial technology platform that helps companies automate their financial processes and increase their productivity. The platform leverages cloud computing and machine learning to identify and execute tasks quickly and efficiently. It automates the entire financial process from start to finish, from data extraction to RFQ, and from execution to post trade.

In addition to automation, Terranoha also offers integrated analytics and audit trail, allowing companies to gain valuable insights into their financial operations. Through this, companies can identify areas of improvement and optimize their processes accordingly.

Overall, RPA is revolutionizing the way companies operate in the fintech world. Companies improve efficiency, and improve customer service. Furthermore, by leveraging the power of cloud computing and machine learning, they are able to gain valuable insights into their operations and optimize their processes accordingly.