Dans le monde rapide du trading Forex, l’efficacité est essentielle. Découvrez comment les technologies d’automatisation et de capture post-trade révolutionnent les opérations, rationalisent les processus et améliorent la satisfaction client.

Rationaliser les opérations Forex avec l’automatisation et la capture post-trade

Dans le domaine dynamique du trading Forex, l’efficacité est primordiale. De l’exécution des transactions aux opérations post-trade, chaque aspect nécessite précision et rapidité. Cependant, les méthodes traditionnelles manuelles entraînent souvent des retards, des erreurs et des inefficacités. C’est là que l’automatisation et la capture post-trade interviennent, révolutionnant la manière dont les entreprises Forex fonctionnent.

Automatisation post-trade : Améliorer l’efficacité

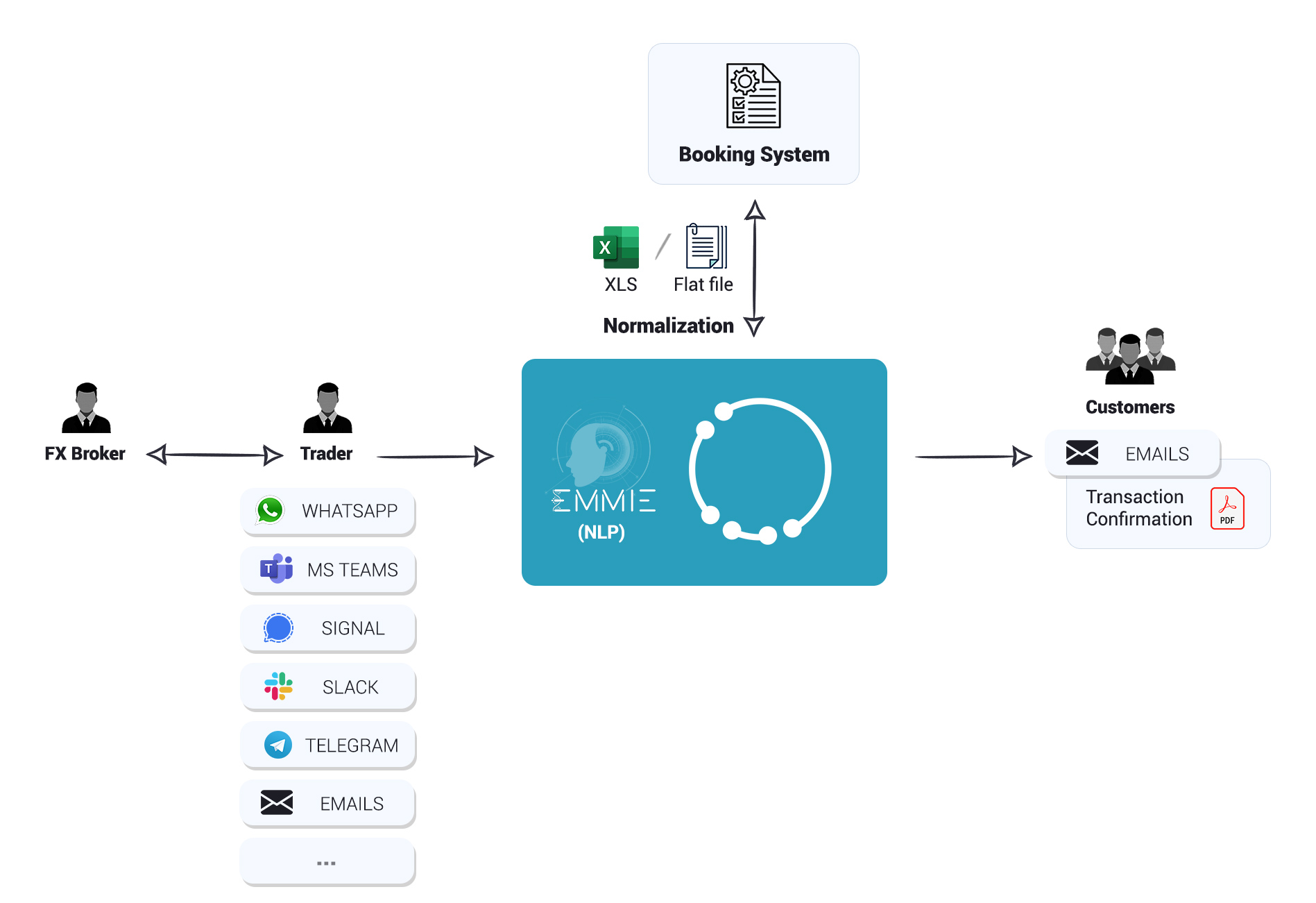

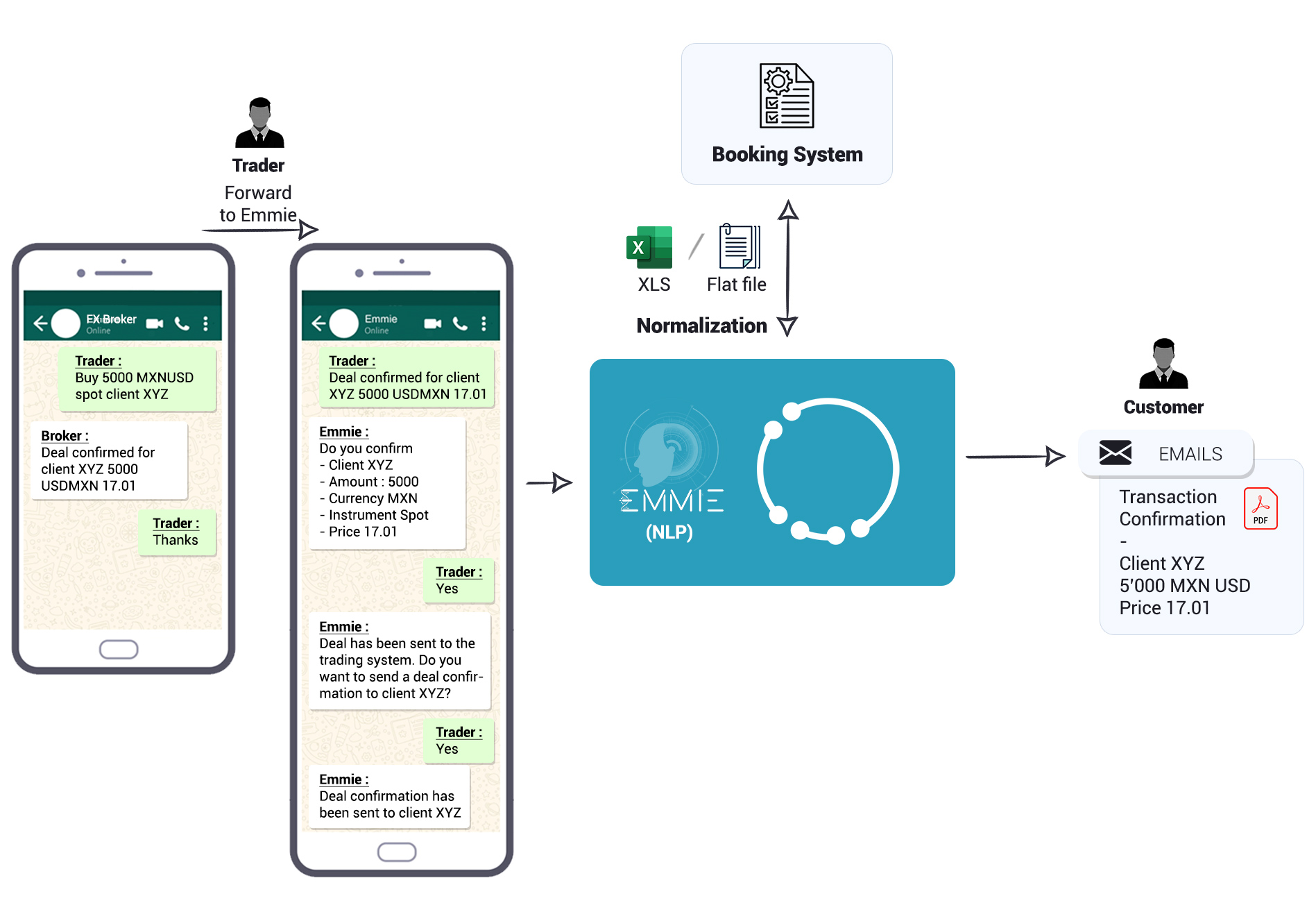

L’automatisation post-trade implique l’utilisation de la technologie pour rationaliser et automatiser les processus qui se déroulent après l’exécution d’une transaction. Elle vise à éliminer l’intervention manuelle, réduire le temps de traitement, minimiser les erreurs et améliorer l’efficacité opérationnelle globale.

Chez Terranoha, nous comprenons les défis auxquels sont confrontés les acteurs de l’industrie Forex dans la gestion des activités post-trade. Que ce soit pour traiter les demandes de transaction, concilier les données ou gérer les risques, nos solutions d’automatisation post-trade sont conçues pour répondre efficacement à ces problématiques.

Avantages de l’automatisation post-trade :

- Réduction des erreurs : En automatisant les tâches répétitives, le risque d’erreurs humaines est considérablement réduit, assurant ainsi la précision des processus post-trade.

- Efficacité temporelle : Le traitement manuel des demandes de transactions et la réconciliation des données peuvent être longs. L’automatisation accélère ces processus, permettant des règlements de transactions plus rapides et un meilleur service client.

- Gestion des risques : Avec des systèmes de surveillance et de gestion des risques automatisés, les entreprises Forex peuvent atténuer efficacement les risques opérationnels et financiers.

- Expérience client améliorée : L’exécution en temps voulu et le traitement précis des demandes de transactions entraînent une plus grande satisfaction et fidélité des clients.

Capture post-trade : Capturer les données de transactions pour l’analyse

La capture post-trade implique la collecte et l’enregistrement des données de transactions pour des fins d’analyse, de reporting et de conformité. Elle englobe la collecte des détails des transactions tels que la date de la transaction, le prix, le volume et les informations sur la contrepartie.

Les solutions de capture post-trade de Terranoha assurent une capture de données fluide et une intégration avec vos systèmes existants. Que ce soit pour capturer les données de transactions issues des interactions clients ou pour intégrer des plateformes tierces, notre technologie simplifie le processus, vous permettant de vous concentrer sur la prise de décision stratégique.

Avantages de la capture post-trade :

- Intégrité des données : Une capture et un stockage précis des données de transactions assurent l’intégrité des données et la conformité aux exigences réglementaires.

- Reporting en temps réel : En capturant les données de transactions en temps réel, les entreprises Forex accèdent à des informations opportunes pour l’analyse des performances et la prise de décision.

- Conformité : La capture automatisée des données de transactions facilite la conformité réglementaire, réduisant ainsi le risque de pénalités et de problèmes juridiques.

- Traçabilité : La capture complète des données de transactions crée une traçabilité transparente, permettant de garantir la traçabilité et la responsabilité.