There is a rapid evolution in natural language processing (NLP) and artificial intelligence (AI). As they do, more and more industries are using NLP to boost their products and customer service. As text examination becomes automated and human responsiveness is improved in the Fintech sector, this is particularly true.

Artificial intelligence (AI) and natural language processing (NLP) are becoming more prevalent in almost every industry, from healthcare to legal. Throughout the financial industry, NLP has made tremendous advances and has been extensively used. Fintech uses NLP for text analysis and human-computer interaction.

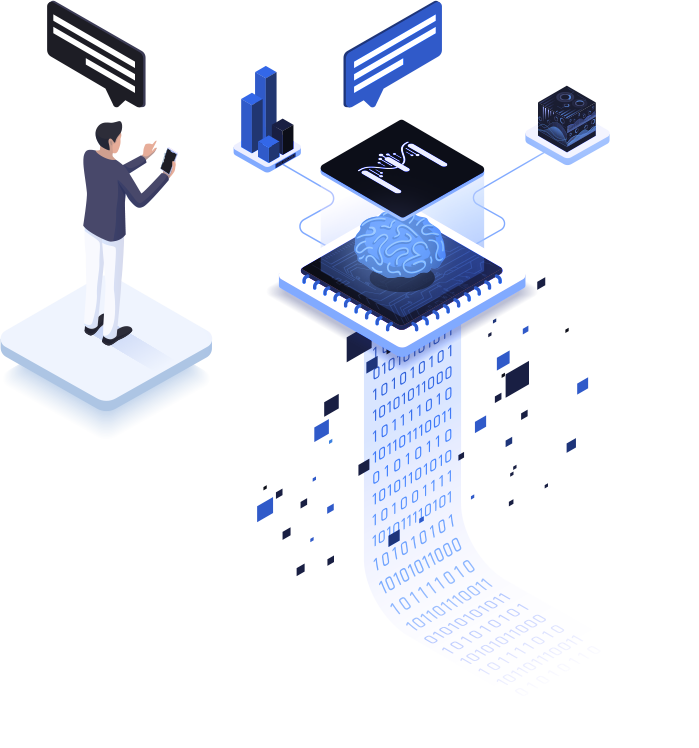

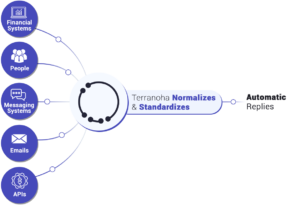

Terranoha has developed its own NLP models via its AI engine called Emmie to automate human trading requests.

A lot of requests are sent to brokers such as request for quotes. Emmie (AI) can assist traders or brokers to automate these processes. Emmie helps the financial area to digitize human requests to trigger action which normally requires human intervention (Give customers a price, send a report or book a deal).

NLP: what does it mean?

‘Natural language processing’ or NLP is a branch of AI that enables computers to comprehend ‘natural language’ or human language. Humans are used to catching specific nuances in languages, but computers/machines may not. Computers use programming languages and must learn grammatical nuances and etiquettes. This is where NLP comes in.

Language processing uses tools to understand the basic definitions of words, phrases, sentences, texts, syntactic (knowledge of words and their meanings), and semantics (understanding the relationship between terms). Furthermore, it develops applications such as machine translation (MT), question-answering (QA), data retrieval, discussion, document production, and recommendation programming.

Emmie AI engine is trained to understand financial sentences and answer accordingly in real time.

If you want to learn about NLP process, we have created whitepapers which explains how the NLP works:

Fintech and Natural Language Processing

Most people have high expectations of their banks, insurance companies, and credit unions. Especially since COVID-19, as more and more customer experience elements have been digitalized, people can expect more from their programs. Real-time tracking of transactions, supervised asset management, and the option to resolve any issue online with genuine care are all things that people today expect. Innovations in finance must demonstrate speed, intelligence, and autonomy for this to become a reality.

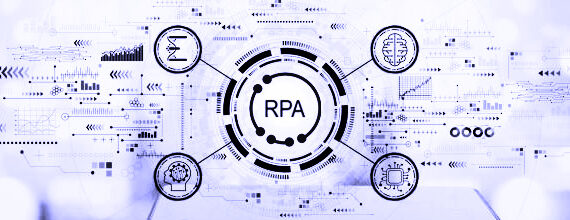

By enabling machines to perform tasks akin to those performed by superhumans, artificial intelligence gives them the ability to behave like humans. NLP and ML play a major role in achieving this.

The use of NLP in Fintech

There are two main uses of NLP in Fintech: understanding human speech and extracting meaning. It involves recognizing intent and coming up with appropriate actions based on requests, claims, and so on. Text mining (pattern recognition) and NLP are used to transform unstructured data from human speech/writings, databases and documents into structured data.

FinTech is embracing AI and NLP in the following ways:

Support for customers

As a result of “conversational banking,” chatbots are becoming well-equipped digital assistants instead of simple chatbots. If you want to stand out from your competition, invest in a virtual assistant with advanced capabilities. In order to perform predictive analysis, they should be able to process context, analyze text sentiment, and analyze text in context. Chatbots benefit from NLP by translating user queries into information that automated systems can use for appropriate responses. As a result, you can:

Insurance technology

Globally, advanced specialists and NLP-based client support are gaining traction. Technology innovations in the insurance industry are designed to generate savings and efficiency. Insurance technology is a combination of insurance and technology, influenced by fintech. Artificial intelligence plays a crucial role in insurtech’s success. Using machine learning applications, efficiency and effectiveness can be improved by processing massive amounts of data. The Insurtech sector offers a wide range of applications, including personalized policies, business policies, and customer-facing software.

Technology in regulation

Financial institutions and FinTech firms use RegTech technology to minimize compliance costs and remove regulatory risk. There is no commercial use for this technology since it is still in development and has a very narrow spectrum. In this new era of AI instruments with natural language processing, we will see:

Examinations conducted by administrative authorities. Tax evasion, money laundering, and terrorist financing can be detected and combated through it.

Terranoha improves the trading area. Using machine learning, many financial processes can be automated, allowing humans to focus on more complex tasks. To learn more about how NLP can help your financial institution, contact us.