Automating FX Requests and Trade Execution with Multi-Channel Messaging Integration for Global Financial Institutions.

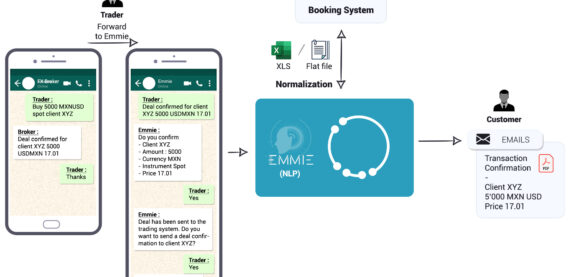

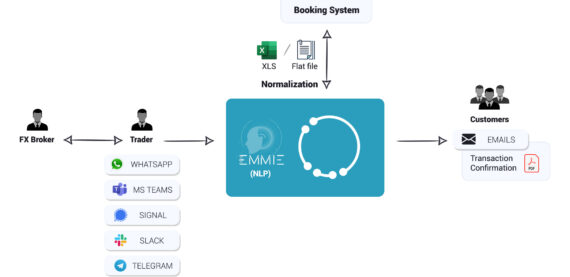

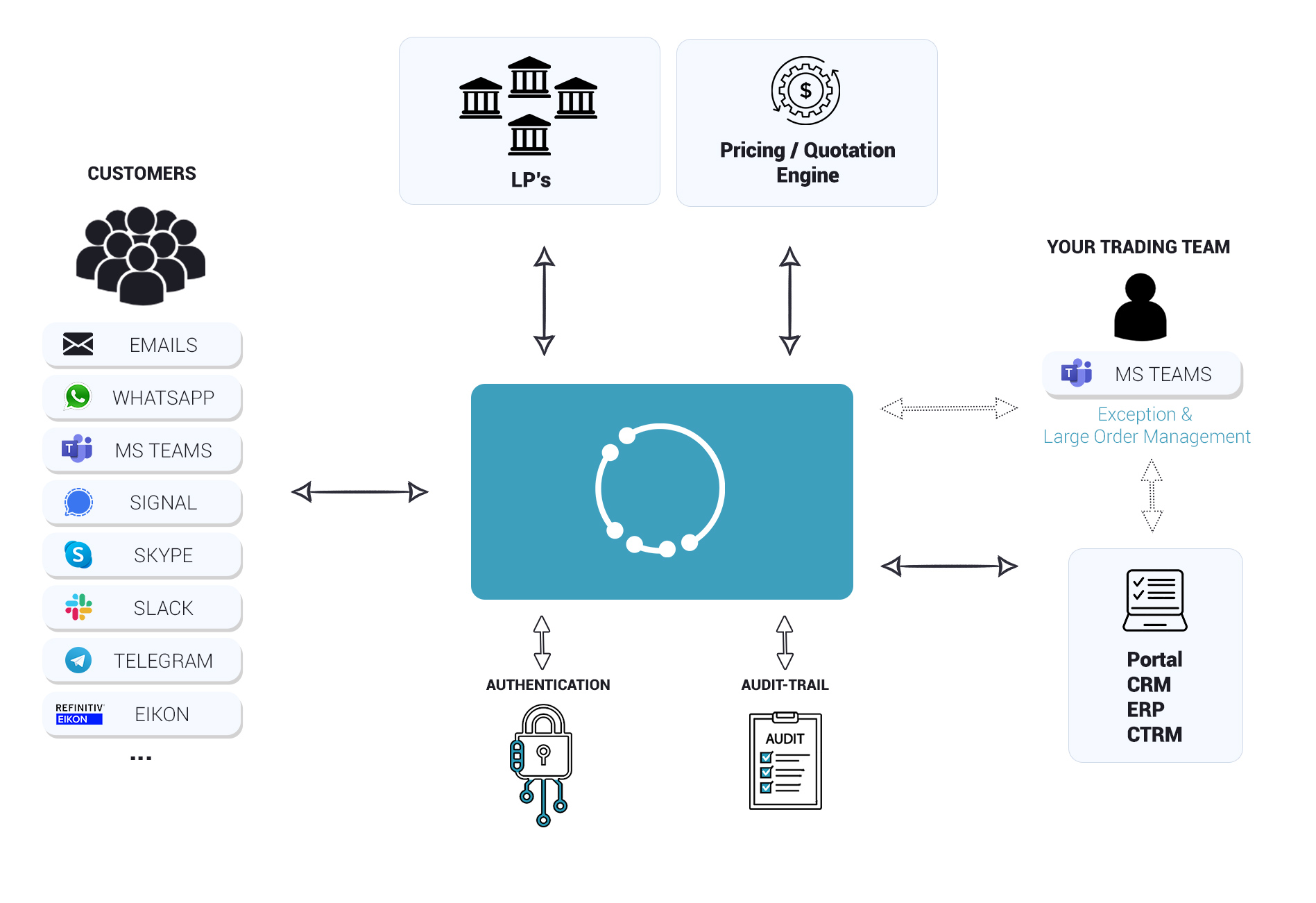

This use case outlines how a global financial institution can utilize Terranoha’s platform to automate the processing of FX requests, manage trade execution, and improve operational efficiency across multiple regions. The solution integrates with the institution’s existing API and multiple messaging systems, enhancing accuracy, reducing manual workload, and ensuring compliance while delivering a superior user experience.

Challenge

A financial institution operating across Europe, North America, and Latin America handles over 200 daily FX requests via multiple messaging platforms, including email, Microsoft Teams, WhatsApp, Symphony, and Refinitiv.

The institution lacks an automated pricing engine and relies heavily on manual processes for handling requests and executing trades. There is also a need for pre-trade limit checks and CRM system integration for client profiling.

Furthermore, the institution interacts directly with major single-dealer platforms like GS, JPM, Morgan Stanley, and Citi.